You’d have to check based on your country, but like @echo64@lemmy.world said in a reply somewhere, companies as far as I know don’t get tax breaks when you donate at checkout.

They do it to look good, don’t get me wrong, but telling people not to donate at checkouts based on a myth is really only harming the charities.

I don’t donate because I’m heartless (is that a win?).

I’m don’t donate because I’m over saturated with requests to donate. I already donate $500 a year to my local elementary school, $500 a year to fund a college entrance award, and then other small amounts here and there, mostly to FOSS projects. My family and I donate regularly to the community fridge and clothing drives.

I think that’s enough, but every single day I need to navigate several phone calls and every cash register. It’s gotten silly.

Thank you for donating but there are tens of millions of people out there that don’t donate at all. At least the register makes it more likely that some of them will throw in a dollar

I see it the exact opposite, I actively avoid organizations that obnoxiously reach out requesting donation via register and cold calling. If I value the charity I donate but the second it starts being annoying I cease donation period. Even moreso the retail store sponsored ones

No you don’t understand, this is exactly how capitalism is supposed to work! Once you get rich enough (and everybody gets rich under capitalism, that’s the beauty of it!) then you can spend as much money you want on things like “helping the poor”, and “food”, and since everyone becomes richer under capitalism, it’s inevitable that the poor will get rich, just like you will be one day! So skip the donating part, invest in stocks, and then when YOU are back on your feet, THEN you can help the poor, so that they TOO can get back on their feet! It’s the perfect system, as long as you don’t donate your money!

I just responded to another comment then saw yours. At least in Murica, the person gets the tax break, not the business.

Relevant article: https://www.taxpolicycenter.org/taxvox/who-gets-tax-benefit-those-checkout-donations-0

I don’t donate because of Kroger wanted to fix hunger they’d just fucking do it. Why does one of the largest corporations on earth need help from my broke ass to feed people?

This really depends on

A) Which country you’re referring to

and

B) How good your accountants are.

Do you think that Bill Gates invests billions in “philanthropic offerings” out of his love for humanity, too? You do get that donations are a massive scam opportunity for rich people, right?

Let’s put it in this perspective:

“I am so rich! Wooohooo! Wololo! So so SO rich! What to do with all my riches? What’s that, IRS? You want me to give YOU some of my grillions of dollars? Well how about I set up a foundation, which invests in philanthropic businesses like, say, MacroHelp Inc.? What if I gave away ALL my wealth to a holding group consisting of only such companies, like MacroEquality, MacroDemocracy, and MacroDelight that promote economic growth in third world countries, FREE OF CHARGE? Clearly I don’t have to pay taxes on THAT, I mean, that’s just pure goodwill, what kind of monster would punish goodwill??”

A, yes. B, no. If you donate to a charity via a checkout, they can’t claim that donation to deduct from their tax liability. You can, but the store count. If bill gates wanted to donate a billion dollars at the check out then he could write that off, not Kroger.

Why would he do it at the Kroger checkout instead of pf donating it straight through one of his subsidiaries?

You are conflating these concepts.

A business offering the donation at checkout doesn’t get to use your donation as a tax write off. You actually get to do that (though it’s unlikely you would get past the minimum deduction)

Bill Gates doing philanthropic work is the same as you donating through the grocery store.

Bill Gates doing philanthropic work is the same as you donating through the grocery store.

HAHAHAHAHAHHA

and it’s insane how many thousands buy into this misinformation because it’s easily digestible. fortunately it’s not malicious, but it’s depressing to consider how much actually malevolent misinformation might slip under the radar without us realizing.

I still remember the time I ran into Woolworths at 7am right as the door opened to buy $400 worth of their paper bags because the delivery of bags our food bank was expecting the previous day never arrived and we had 800 hampers to pack that day.

I was wearing my uniform and I had my card with me to get the wholesale discount as part of the agreement our organisation had with woolworths.

The store manager recognised me as I walked in and ran off to grab some unopened boxes of bags for me.

When I hit to the checkout the cashier ran everything through, applied the discount, and even engaged in some mindful small talk about how busy we were expecting to get today and if Aldi had stopped giving us green bacon (they had not).

Then when we were almost done the cashier asked if I wanted to donate to Food Bank.

While I’m standing there holding a Food Bank charity partner wholesale card, wearing my Food bank charity partner uniform.

I said “uh, no, thanks” and I suspected the the cashier was on autopilot when she said “really? But it’s for food security” I said no again and they asked why not, at that point I realised that they weren’t on autopilot, they genuinely didn’t understand why I would not be using the food bank charity partner debit card to donate to food bank via woolworths.

She said it wouldn’t matter because the money would “go back to food bank eventually” (ignoring admin and financial management costs, it’s a net loss)… So why would I donate it if it would litteraly do nothing to benefit food bank other than give Woolies the opportunity to say they donated x money to food bank, bich that’s basically fraud.

Leaving the fact that you were working for a charity organization - is it even legal to make a donation-of-opportunity when you buy something on behalf of someone else, using their money?

This is a really good point that I hadn’t considered at the time.

I’m always wondering this when my current boss (working at a different organisation now) will tell me to uber somewhere because it’s too far for me to cycle and use the company debit card.

I hate that American style tipping culture is becoming more common in Australia, but I hate the idea of someone not being paid a fair wage even more, and my boss is on the same page, but I still second guess myself every time I go to enter the tip because its not my money, so I’m always trying to decide how much to tip based on what I think is fair but also what our accountant might say.

Not to mention how many carers and support workers and financial powers of attorney would be asked to make donations of opportunity. I wonder if there are sort of “financial intentions” documents people can prepare in advance with trusted people to say “these are my values, if a charity aligns with my value’s, my carer can donate up to $y of my money or x% of my income per year”

Wtf is green bacon?!

It’s from a dr Seuss book

Well I don’t like it! Seriously!

But it was just eggs & ham

Bacon that’s old enough that there’s nothing else to do with it but give it to a food bank I suppose.

Dang, not sure I’ve cooked green bacon, but I’ve cooked grayish bacon and it comes out ok. It kind of makes me feel better to know they donate expiring meat. It’d be better if they donated it a little earlier, like no one’s buying the gray bacon, but it’s still edible.

Well, I’m hoping, it’s a Saint Patrick’s Day special, because there’s nothing environmentally friendly about bacon…

So you explained it to the employee and they still didn’t get it? You are already donating your time to the food bank, I feel like most people would understand if it were framed like that.

Not even just that, the money they were spending was the food bank’s money, and the card was labeled as such.

I was a staff member, so it wasn’t exactly donating my time (though I won’t deny I put in a lot of free overtime and rarely took the allotted breaks, so some of my time at that organisation was donated, but I was a paid staff member)

The bigger issue was that they money I was using did not belong to me, it already belonged to the charity that I was being asked to donate to.

I wish comics would go back to being funny. Everthing is dark and snarky now. The world sucks enough as it is. Now things we went to for distraction from it are just illustrating it even more.

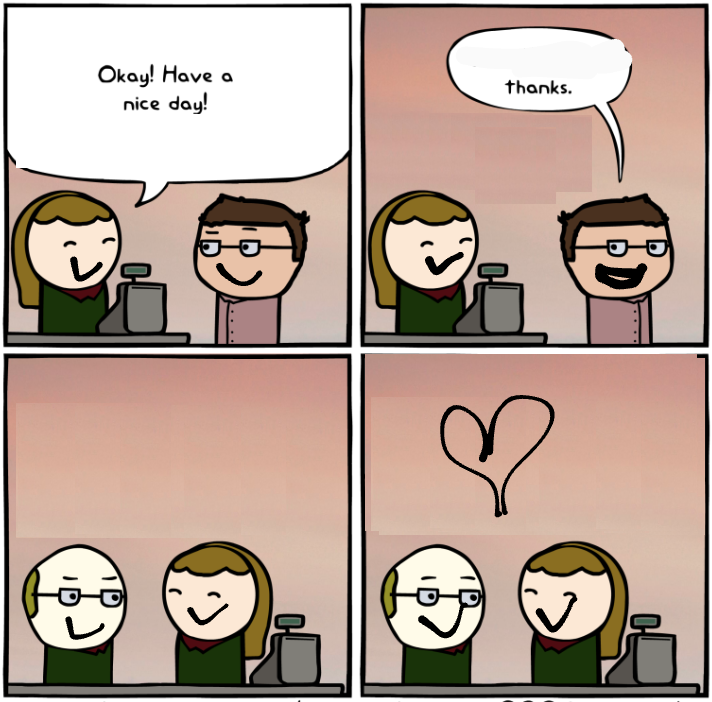

sniffle Beautiful 🥺

spoiler

Maybe we should devote a sub to sappy edits of dark/snarky things that are brain-rottingly sweet or completely ruin the point of the original

Use this: !webettercomics@lemmy.world

Wanna be a mod?

Hi there! Looks like you linked to a Lemmy community using a URL instead of its name, which doesn’t work well for people on different instances. Try fixing it like this: !webettercomics@lemmy.world

Thank you, Lemmobot!

deleted by creator

this is based on a true story

Now it’s as if he doesn’t want to have a nice day

“Deleted”

by: Creator

deleted by creator

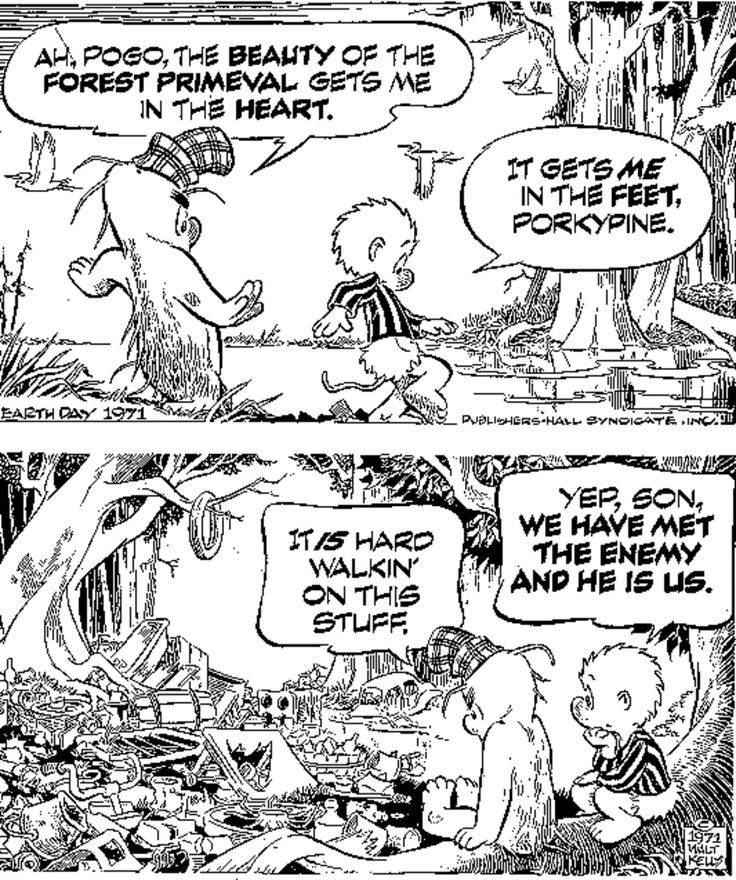

53 years ago:

Couldn’t quickly tell how to do alt text from my phone app but it’s an old newspaper comic called Pogo, in which two anthropomorphic animals are speaking while traversing a bog.

First panel:

Porky Pine (a porcupine): Ah Pogo, the beauty of the forest primeval gets me in the heart.

Pogo (a possum): It gets me in the feet, Porkypine.

Second panel, characters sitting, looking out over a part of the bog used as a dump, a visually unparseable sprawl of assorted rubbish:

Porky: It is hard walkin’ on this stuff.

Pogo: Yep, son, we have met the enemy and he is us.Yeah, it’s sad that everything doesn’t have to cater only to what I like.

Probably best to just filter this shit out of my feed.

Maybe we should just filter all of the shit out of our feeds!

Reality escaper spotted 🔭

deleted by creator

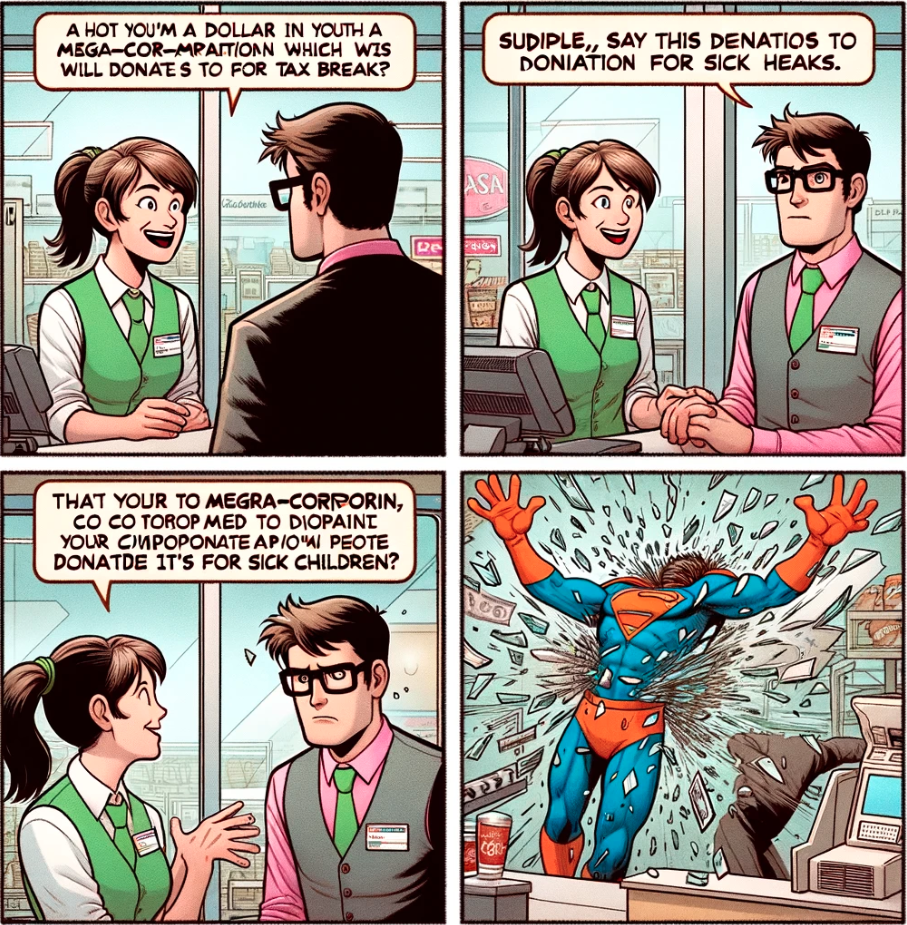

make it better

USER: I made a comic. Make it better!

CHATGPT4:

USER: Make it even better!

CHATGPT4:

How about this?

deleted by creator

can confirm, you did indeed make it better. not the it I meant, but certainly a proximate, relevant it was selected.

Well, I think some of the credit should go the the AI.

Art often reflects society. There are plenty of artists who don’t do this.

deleted by creator

Maybe it depends on country, but AFAIK they only get the tax breaks on the ammount donated. (The person who donated, too btw… If you keep the recipes and put it on your tax return filing, you should get a fraction of taxes back.)

I think they actually do it, because either the bosses have friends/relatives working for the non-profit or the non-profit also has operating costs and the mega corp profits off of those.

Yes, so they take your money, donate it to a cause that they are aligned with (possibly under the same corporate structure)

take a tax credit on a portion of what you gave them to donate (which helps reduce their tax burden to near-zero),and enrich their friends in the process.At least in the US the part about individuals getting a tax break would only apply if they’re itemizing their deductions which usually works out to be higher tax rate than the standard deduction for the majority of people.

It doesn’t reduce their tax burden, as they are receiving extra income from your dollar. There’s no tax loophole here.

The benefits to the company come from “look at all the charitable work we did last year”, and sometimes croniesim as op pointed out.

In the U.S. we really need to decouple charitable donation tax breaks from itemization.

Also, why not raise the standard deduction to say, $75k and tax billionaires whatever it takes to make up the difference ¯\_(ツ)_/¯

Get out of here with your reasonable suggestions!

~~Because why would anyone exploit themselves if we made it easy for the poors to survive?~~Because why would anyone work hard to become a billionaire?

You’re saying they save more in tax than the amount you donated? I thought they just didn’t get taxed on that money (which is fair as it’s not really income if it’s getting passed along).

I always just say “No thank you, I donate directly.” And I do.

This is certainly an important point and all, but the store is at the very least providing a huge promotional service. How much more does that particular charity get over the course of a year due to this free promotion.

It’s a little weird to me that we’re at the point of “I’m not going to donate to sick kids if a corporation I already shop at also gets some small benefit!”

Studies show that people really do give more overall with these campaigns.

And people also really don’t understand how write-offs work around here in general. It’s not some magical way to invent money. Money that’s written off is not taxed, but that doesn’t make it not money spent.

For easy math, let’s say your tax rate is 20% and you give $100 to a charity and wite it off your income. That means you don’t pay the $20 in taxes you would have owed otherwise, which brings the effective cost of the donation down to $80.

There’s no magic trick where you give money to a charity and suddenly have more money because of reduced taxes.

I understand the write off part. The part I don’t understand is if you give me $100, and then I donate the $100 (so cost of donation becomes $80), do I have to report that your $100 donation to me as income? Or did I just use your money to decrease my tax burden?

On a personal level you can deduct it from your income, but only if it passes a certain threshold…but also, it doesn’t really count as income before a certain threshold, so realistically, at that quantity, it doesn’t matter.

It starts mattering when you start dealing with donation quantities nearing like, $10000, because then you start to run into the standard deduction (the assumed amount that “well everyone just donates this amount, we don’t need to keep track of it all before then, we’ll just hand that exemption to everyone”). I forget what the gift threshold is in a similar vein, but it’s not as low as $100.

Edit: I went through all that and didn’t really address the core of the question. If you get paid a large amount of money, say, $20,000 and then donate all of it, ignoring the standard deduction whackery as discussed above (as a corporation would effectively do), yes, your taxes will have you deduct all of the donation from your income (you will not have to count it as revenue, essentially) if the group is registered properly with the IRS. You do not reduce your tax burden further than you would have if you had not received the donation, you essentially get taxed as though you never got the money at all.

From the store’s perspective, money donated through the point of sale and given to charity is neither income nor a deduction. It’s just the collection of money that doesn’t count as anything to the store’s finances.

In the same way, if I pay rent for my entire unit and collect the portions owed from my roommates, the money my roommates pay me don’t count as my income. I was just passing it along, and it was never mine to begin with.

Yea I guess I was thinking something like this

- I earned $100,000 revenue

- You give me $20,000 donation

- I make a $20,000 donation

- I report on taxes I earned $100,000 and donated $20,000, so my taxable income is $80,000 because I wrote off a donation you gave me.

I would have to include the donation either in my earnings or report it some other way.

The Smile.Amazon program was pretty rad. I managed to contribute some extra funds to the EFF and talked a few friends into picking them as their charity too. I think the EFF received almost a million dollars from that program. Then one day Amazon was like “nah, we hate helping people” and just cancelled the program.

I stopped seeing things about it but I didn’t even realize they killed it. What a shame.

They said it didn’t have as big of an impact as they had hoped, so they were cancelling it. A rational person would say “it’s not as impactful as we want, so we’re improving it”, but big corporations are all about killing projects.

I’m just a bit disgusted by the concept. Like McDonalds gives the slightest shit about sick kids or whatever. But i don’t know the actual impact or reason they do it, i just distrust it.

Money not put back into governmental systems that are deeply underfunded and the fact that charities are required to only spend 3% of their cash reserves per year on actual charitable costs means that a lot of charities are basically you paying directly to the bank account of a few rich people who employ and enrish themselves off the interest.

Something like only 13% of charities don’t pay themselves a salary. Which I don’t expect there to be no overhead costs and charity can be great for specific topics that need more nuanced approaches but a lot of charities are just a big business.

Okay, I was not expecting the double-down to be “checkout donations are bad because all donations are bad.”

I am also jaded enough to believe most “charitable organizations” are not very charitable.

I’d rather donate to something I know like my local volunteer fire department or community association rather than some org that has too much overhead. And I’m not interested in researching if every org asking for donations is reputable.

I know right? It’s annoying and I don’t even think all charity is bad it’s just a whole lot harder to find actual charities.

You are just choosing to pretend I’m talking in absolutes when I point out glaring issues in our current setup.

Did you know in 2017 the number of Americans making tax deductions on charity donations whent from ~50 million Americans to 15 million without the amount of donations decreasing?

The amount needed to claim was just raised so only richer people could take advantage of it. Only those making more than 3 million a year can now get tax incentives on donations essentially.Charity is broken at the moment. It’s been set up to make money in lots of cases and that isn’t easy to navigate in a simple absolute.

I’m not pretending that’s what you were actually saying - perhaps it’s a little unfair of me to make such a glib comment at your expense.

The truth is that I do understand your point and I starkly disagree. I do a lot of work in the nonprofit world, and at least in the USA, most charitable organizations are doing vital work and making an important difference in peoples lives (or animals, or the earth, or whatever). While there are a few large bad actors that come under scrutiny, and a few fly-by-night operations, charities that solicit public donations do good work.

The abuses in the charity laws mostly have to do with family foundations, and they are not the ones standing on the corner with their hand out. These “private” charities can easily be used as tax shelters and all variety of shenanigans. “Public” charities have to be better because they are under a spotlight more intense than most businesses could stand. they have to be better.

I also don’t think raising the minimum standard deduction harmed families - in fact it made it easier and cheaper for most Americans to file. You can always still itemize your donations if you want to.

It’s not that the corporation would get a small benefit. It can be fairly sizable. And what corporations don’t pay end up as government debt

What benefits? Publicity sure, but they don’t get tax breaks for collecting donations.

And if you ask out every single girl you meet, you just may get lucky once in a while. Doesn’t make the practice okay.

My problem is the store asking for me to donate could just as easily donate from their Olympic sized swimming pool of profits and solve the issue right there.

Yes, it’s not much different from tipping. Puts the burden of responsibility in the wrong place. If a business wants to support charities and use it in marketing, just give money to charities and tell people how much it was. And/or give people the contact details of the charities if you want to promote them.

your grocery store can only get a tax benefit from a donation if they are donating a share of sales. in the more common case where you “round of up for charity,” you are the one who is eligible for a tax write off

I appreciate the info, I had no idea :)

It’s not the tax write off that benefits the executives. It’s the fact that they appoint themselves as executives of the charity too, and as such they can legally pay themselves a salary out of the donations they receive.

Got $10m in charity donations? Whoops looks like our executives’ salaries cost $9.9m, guess we can only donate $100k

[sorry for the wall of text rant below, I know this is just a comic we’re talking about here lol]

At least in Canada I know this is one of the most important annual campaigns for non-profits to bring in operating funds.

And, the Walmarts (for example) that have a manager that are into the fundraising bring in way more than the ones where the manager doesn’t care… Mostly because the cashier asking greatly increases the amount of donations.

I get that the business doesn’t do it out of the goodness of its non-existent, corporate heart - and gets tax breaks or whatever - but it really does help the non-profits.

If I had my own comic strip, I’d do a rebuttal:

Cell 1: person standing at cash, cashier says, “would you like to donate to non-profit organization ABC today?”

Cell 2: person rants: “you know, this is what’s wrong with the world today. Faceless corporations are acting like charities and taking more of our hard-earned money so they can get tax breaks and not actually contribute anything to society. I’ll donate at home and get the tax break myself, thank-you-very-much!” cashier: “uh huh, that’ll be $23.45”

Cell 3: [6 months later] person sitting at a desk: “alright, tax time, just gotta fill out these forms. Donations? Right, donations, donations… Hmm…”

Cell 4: [shows tax form with a prominent field of “Donations” and a big “$0”]

The real problem is needing these donations at all. These kind of things should be government funded for at least 90% if shit worked correct.

Completely agree, charity is a symptom of something wrong in a society. If something needs support and is worthwhile (and you assume charities are for worthwhile causes), why as a society is it not being done?

If you look at a lot of charities throughout history, it’s almost like they’re really there for the powerful to play with their pets …

That’s fair, I’m certainly not addressing that.

The comic was about the charity/corporation/individual interaction and I’m just talking about the fact that given the situation they’re in, charities rely on donations in this form.

That’s a ridiculous strawman to build, not donating via a corporation to a corporation (which the big non profits that these campaigns tend to raise funds for operate like) absolutely doesn’t equal not donating anywhere else, if anything, people who are that aware of what a scam corporate charity is are significantly more likely to be donating and volunteering locally and directly, You’re also leaving out that these corporations aren’t just faceless and heartless, but are active contributors to maintaining the status quo and the systems that create the conditions where these charities are needed in the first place. Making any excuse for them being a middleman - for their benefit because if it wasn’t they wouldn’t do it, is completely missing the big picture.

You didn’t address the fact that this is still one of the top ways non profits bring in funds.

Why would I donate so a corporation can get a tax break or good press out of my money?

People who donate at the till are probably the people who tip on drive thru orders.

As much as I hate corporations, getting a tax break with your donation is actually something shitty they’re not doing. It’s misinformation, the donator gets the tax break, not the corp. At least in the United States.

Here’s an article explaining it: https://www.taxpolicycenter.org/taxvox/who-gets-tax-benefit-those-checkout-donations-0

With that being said, will corporations lobby to change tax policy so they get the write off? Probably!

I read something about this. While they don’t get a tax break, they can hold on to the money for as long as they like… I assume, but don’t know, they could collect interest on it.

So, just fuck the people actually making the food? The tip should go to the fancy person who just holds your food for 30 seconds?

Nah tipping at the drive through is better

The only argument I’ve heard for tipping is that “servers don’t get paid minimum wage and rely on your tips” which has nothing to do with the kitchen.

So yes, fuck tipping. Get angry at your boss for not paying you enough, not at me for not subsiding their shitty wages.I’m not back of house. In fact, when I was in the service industry, I was front of house and pretty damn good at it. But even the best paid cooks I’m more than happy to tip out because I’m fat and I love food. Most of the times I’ll but a round for the whole back of house, dishwasher included. But I’m not gunna do that at Sonny’s drive through.

LoL. Yes. Yes exactly.

deleted by creator

This is you donating to the non-profit. You get the tax break, the company does not. I’m so sick of this misinformation because nobody actually donates on their own, which is why non-profits partner with companies for fundraising.

It’s on your receipt, you get the tax break. As simple as that.

Like that guy at the train station used to say: “20 bucks are 20 bucks.”

20 bucks are 20 bucks.

That’s far from true, though. According to my sources, 20 male deer cost a LOT more than $20.

So that’s how you letter a pregnant pause into a comic panel.

Fired

99% of people aren’t donating to shit. What do you care what the corporation gets as a benefit as long as the charity gets the money? Money is money. Stop trying to justify being cheap.

Well this gives me a whole new perspective on things 🤔