- 114 Posts

- 52 Comments

Although I agree with you, I don’t think that’s what OP was asking about based on this part:

I’m just thinking that if a hacker got access to one email they’d have all account information?

It seems they are asking if an separate email account for each service would be beneficial. My opinion is it would limit the attack if an email account was hacked, but definitely not worth the hassle. Email aliasing (like the comment above me says) gives you some of the benefits without needing to juggle multiple accounts.

8·1 month ago

8·1 month agoI believe what they mean is “fuck car centric societal design”. No reasonable person should be mad that someone is using the current system to live their life (i.e. driving to work). What the real goal is spreading awareness that a car centric society is inherently isolating and stressful, and that one more lane does absolutely nothing to lessen traffic (except for like a month ish)

2·1 month ago

2·1 month agoAh thanks, this makes a lot more sense!

7·1 month ago

7·1 month agoIf you watch municipal or provincial news conferences it’s fairly common to hear a First Nation blessing at its start, like a recent one in front of Nanaimo Regional General Hospital on Tuesday.

“The increase in Indigenous content is a good sign. It shows that municipalities are stepping up and, at least symbolically, embracing reconciliation and this is also a category of action that falls outside the Supreme Court ruling in Saguenay,” said Phelps Bondaroff.

Honest question: isn’t having the First Nation blessing violating the same constitution that the prayer is? Obviously the prayer is an obvious violation, but replacing it doesn’t seem to be the answer as far as I can tell.

1·2 months ago

1·2 months agoFor sure, but that still isn’t a passkey. The method you are talking about is the equivalent of non-passphrase protected SSH protocol, which is a single form of authentication (i.e. if someone has your security key they have your account).

The term passkey implies MFA: having a physical key and a password, a physical key and a fingerprint scan, or equivalent.

Sure the username could be considered the password, but usernames are not designed to be protected the same way. For example, they typically are stored in clear text in a services database, so one databreach and it’s over.

15·2 months ago

15·2 months agoYes, as long as that place is only accessible by a physical passkey (such as a Yubikey). The risk is miniscule and the convenience is 100% worth it.

3·2 months ago

3·2 months agoPasskey = Resident Key

Nonresident keys are not passkeys, they are solely a second form of authentication meaning the service you are logging into still requires a password.

21·2 months ago

21·2 months agoThe real question is whether this was put up on April 2 or is a really old sign from Feb 4. ISO 8601 saves lives people, but probably not as many as proper lock out/tag out procedures.

2·2 months ago

2·2 months agoHappy to help! If I had to pick just one it would probably be TD or Wealthsimple (with Tangerine as the runner up). TD because of the All Inclusive account that has no fees with a minimum balance of $5000 and a bunch of extra perks like a pretty great premium credit card. Wealthsimple because it’s the hands down best investing option (highly recommend visiting this website for guidance). Tangerine is close but I just can’t fully stomach their security and how they don’t implement some ease or use features (most other banks I’ve experienced have them all so they have no excuse).

Moving money between EQ and Tangerine really only nets an extra few hundred per year at most, so it’s not super worth it honestly. I do it because I like the little bit extra. You’re correct there, I move it only when Tangerine offers a promotional interest rate for their HISA that is higher than the HISA at EQ.

5·2 months ago

5·2 months agoI can provide some info about TD, Simplii, Tangerine, EQ, and Wealthsimple (more of an investing service than a bank):

Online Banking Experience:

- TD: Webapp works but is not pretty. App is more polished.

- Simplii: Webapp is similar to TD in lack of polish. Mobile app is similar to the other two above.

- Tangerine: Webapp is a bit better than the above two. App is more polished.

- EQ: Webapp is a bit more polished like Tangerine. Mobile app is a little worse than the above but still fine.

- Wealthsimple: Probably the best webapp and mobile app experience.

Credit Cards (Ease of Use):

- TD: Many credit card options and can automate payments for it from any institution (I believe).

- Simplii: They have a free card that has 4% back on restaurants which is pretty cool. Can be automated from other institutions.

- Tangerine: They have a very cool free credit card (2% back on 2-3 user selected categories). Annoyingly though, you can’t automate payments using another institution.

- EQ: No idea about credit cards.

- Wealthsimple: I believe they just released a new credit card. No idea how good it is.

Fees:

- TD: They have an account that if you keep a minimum $5000 in it, there are no fees and you get some extra perks (free premium credit card, etc.). Other than that, the free account with no minimum is pretty limited.

- Simplii: Free accounts and credit cards.

- Tangerine: Free accounts and credit cards.

- EQ: Free accounts. Not sure about credit cards.

- Wealth simple: Free account. Not sure about credit card.

Etransfers:

- TD: etransfers have a fee but is waived if you hit the minimum in the account.

- Simplii: free

- Tangerine: free

- EQ: free

- Wealth simple: no idea. Don’t think they allow etransfers.

Security:

- TD: Security is okay. They have a standalone authenticator app, so they need to step it up, but sadly they are still one of the better ones in Canada.

- Simplii: Meh security. Normal passwords and SMS 2FA.

- Tangerine: Awful security. Your password can only be a 6 digit numerical pin. Thankfully they require 2FA but only using SMS.

- EQ: Meh security. Normal passwords and SMS 2FA.

- Wealth simple: Good security. TOTP available and I believe passkey is here or coming? Not sure about that last part, but I wouldn’t be surprised with how ahead of the curve they are in this area.

Rewards:

- TD: Rewards depend on the credit card here.

- Simplii: Rewards are just in credit card.

- Tangerine: They have various rewards throughout the year. Usually temporary boosts to the interest on their savings account.

- EQ: Nope.

- Wealth simple: Nope.

Investing:

- TD: No idea.

- Simplii: no idea

- Tangerine: no idea

- EQ: Can buy GICs here but no idea otherwise.

- Wealth simple: The best since it’s an investing service.

Misc:

- TD: Great customer support and very established. Has lots of options for accounts, cards, etc.

- Simplii: No in person access.

- Tangerine: No in persona access. Security is abysmal but the other services are pretty good.

- EQ: Typically has the highest interest rate of all Canadian banks for the savings account. No in person access.

- Wealth simple: Great for investing and a good service!

What I do: I have my everyday banking with TD, savings with EQ, and investing with Wealthsimple. When Tangerine gives a promo, I move my savings there until the promo expires, then I move it back to EQ. I have credit cards with a bunch, but the one I’m considering ditching is the Tangerine one since payments cannot be automated through another institution.

6·2 months ago

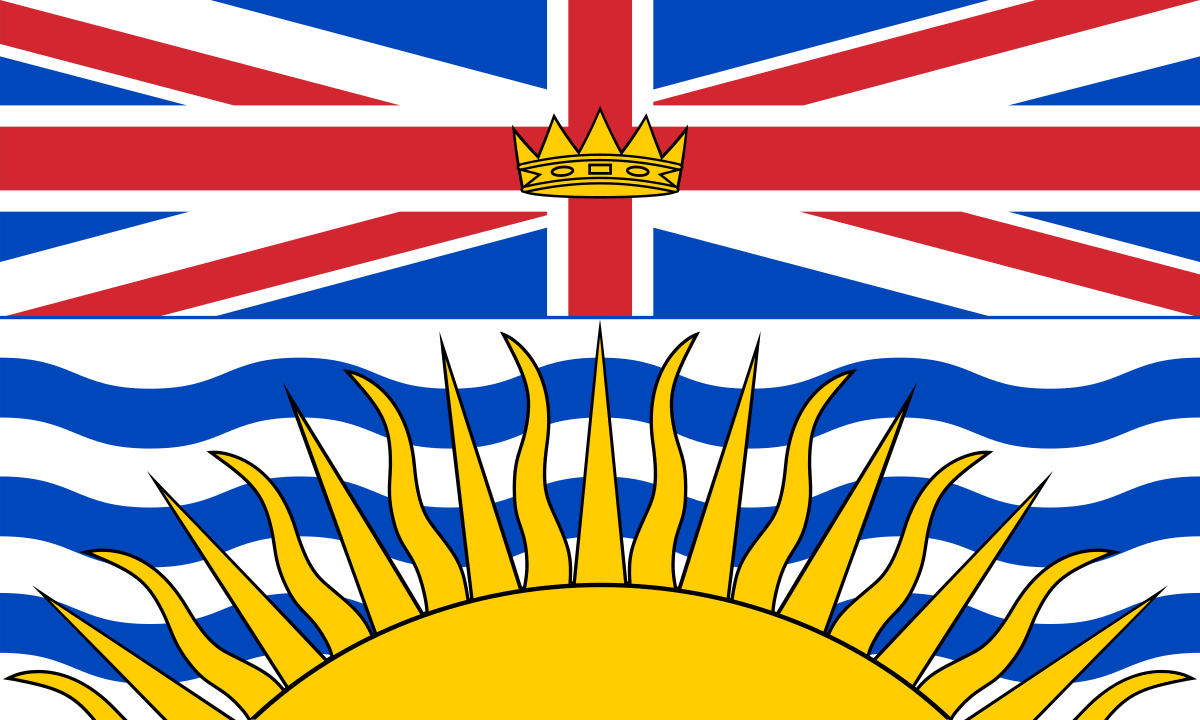

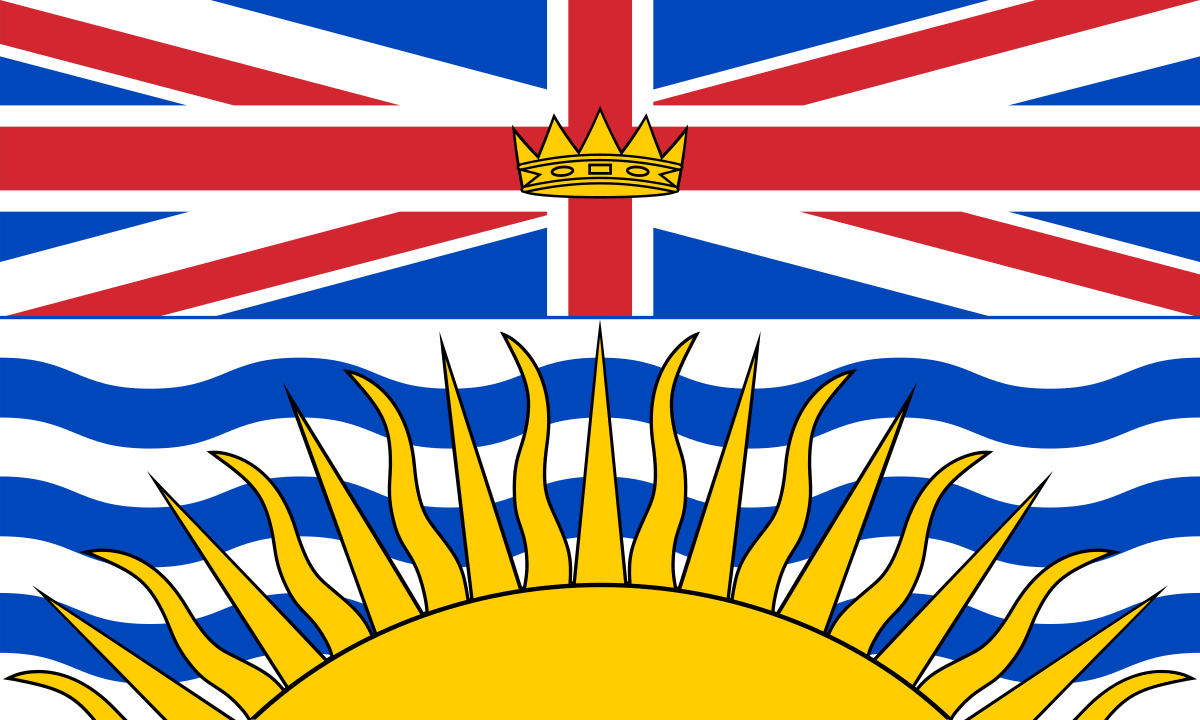

6·2 months agoCanada. Now you know two! Granted, we are basically the 51st state at this point…

Not commenting on the argument, but just FYI: “Slippery Slope” actually refers to an argument that could include a slippery slope fallacy, but not necessarily. A slippery slope fallacy is an informal fallacy, meaning that any errors are in the content and not the format of the argument (i.e. the slippery slope argument itself).

1·4 months ago

1·4 months agoActually it is possible to do it locally! A photo management service called Ente.io is already implementing it.

1·4 months ago

1·4 months agoIt’s 20.7 Ford F150s long

Seems like the support email is a canned response. Obviously still frustrating, but did you try clarifying with them in a response email?

1·4 months ago

1·4 months agoHence the “hard lesson” part. A lot of us tech-focused people learned the same lesson with our document backup systems. You lose some important documents, then you realize you really should backup your stuff. All I hope is these people learn the lesson earlier in life before the consequences become more and more severe.

6·4 months ago

6·4 months agoOr just make it clear your account is gone if you lose your passkey, so have a second key for backup or learn a hard lesson.

Nope, no way to do this. It’s not implemented yet. What you could use instead is the app called Shelter to create and manage a work profile. It’s less separated than another Graphene profile, but is much more convenient